ENERGIZED: Investment Insights on Energy Transformation

Edition 7

Grid Resilience: Investment Implications of “El Gran Apagón Ibérico”

6 May 2025

Please note: This newsletter is for general informational purposes only and should not be construed as financial, legal or tax advice nor as an invitation or inducement to engage in any specific investment activity, nor to address the specific personal requirements of any readers. (Full disclaimer below).

Key Takeaways:

Grid resilience will become a higher priority for politicians and regulators, and therefore a rising energy investment theme

Electrification and more decentralised and multi-directional power grids put greater value on provision of system inertia and frequency response services. This will support the growth of battery systems, which can respond fastest, accelerating their rollout particularly in less saturated markets like Spain.

It will also underpin further investment in grid interconnectivity and equipment like grid-forming inverters, providing additional tailwinds for grid-tech and electrical suppliers who are already in high demand.

Finally it will also help boost the business case for demand response technologies like Virtual Power Plants.

Spain Unplugged

Hot on the heels of the Heathrow transformer fire in March, last Monday 28 April saw el gran apagón ibérico, the great Iberian blackout – the biggest in European history. We were about to publish on a different topic, but this extraordinary event sharply refocused attention on a different kind of energy security: how robust will grids be in increasingly decentralised, multi-directional power systems and how to guarantee their resilience?

One thing the apagón quickly reinforced is that we live more than ever in a world of knee-jerk opinions, with facts following slowly behind. That this incident occurred in Spain, the European poster child for rapidly accelerating clean power generation, at a moment when well over half of generation was coming from solar, was more than enough to ignite the debate. Within minutes, an epic energy whodunnit erupted online, with a speculative bandwagon swiftly mobilising to fit the incident into preconceived worldviews on the merits or otherwise of high renewables generation, before giving way to more reasoned technical interpretations of the available facts.

Before we assess the likely signals for energy investment, it’s worth briefly clarifying why this shouldn’t be just another chapter in the endless debate for and against renewables. The initial drop in frequency may have been triggered by a solar farm tripping – whether that is true and if so what caused that trip is not yet known. So far, it appears that two almost simultaneous incidents may have been behind the loss of control. More data will emerge in due course but in any case, that’s not really the point. Any generation source can trip – and they regularly do. What matters is how the grid responds: how its layers of protection kick in to prevent a trip from cascading across the wider system. The investigations will mainly focus on why these failed.

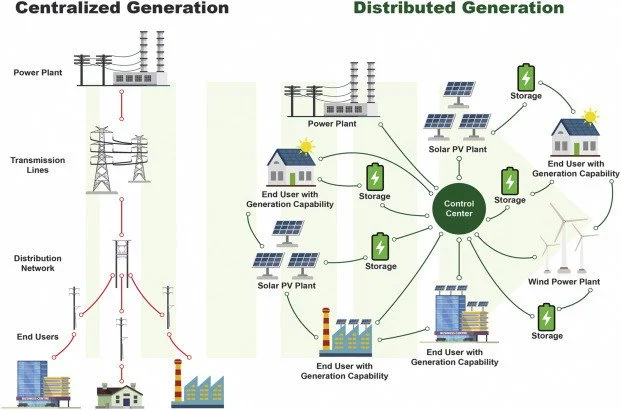

Traditional centralised grid vs the distributed generation model of the future

Frequency and inertia – why so important?

Of course, such incidents are stark reminders not just of our total reliance on electricity, but also the profound interconnectedness – that is, interdependence – of our modern infrastructure. If life being stopped instantaneously in its tracks is bad for business, it’s a political embarrassment. The predictable finger pointing in Spain is already well underway. But beyond that noise, we can be sure that grid resilience will now become a higher priority for politicians and regulators – and therefore potentially for investors too.

As we move into a more electrified future powered by higher levels of clean energy generation, no doubt this will not be the last such electric shock. System resilience is part of daily life for grid operators, but has been taken for granted by its beneficiaries. Renewed focus on grid resilience wherever renewables already penetrate deeply or are fast gaining market share (i.e. most of Europe) implies greater market value for frequency management services.

What does that mean? Put simply, grids must continually balance supply and demand every second of every day. That entails maintaining frequency at or within a very tight band around the target level, typically 50 Hz. Frequency is the number of alternations between positive and negative voltage – think of it as the heart rate of the electric system. The service of evening out any oscillations (typically in the +/- 0.2 Hz range) is known as frequency response. This service provides economic value by ensuring grids continue to function smoothly. Higher amounts of inertia in a system enable faster readjustment back to target frequency level, and vice versa.

Traditionally, thermal and hydro power plants have provided inertia as a free by-product of their spinning generators. However, as they gradually fall out of the merit order of modern grids, that inertia also recedes, removing a frequency response buffer. By contrast, the solid state inverters typically used in solar and wind installations lack such inertia and therefore can’t participate in frequency response. With very high solar generation at the time of the apagón, it provisionally appears that the Spanish system may have had as little as ~1 second’s worth of inertia available.

In the event of bigger frequency drops (>0.2 Hz), electricity substations are programmed to automatically disconnect to protect the system balance and asset integrity. The lower it drops, the more that needs to be disconnected. Ordinarily this would help to contain an outage locally. However, if there is insufficient inertia to readjust fast enough, lower frequency can then trigger automatic disconnection of other power plants, cascading into a wider blackout as seems to have happened in Spain.

Implications for batteries

No doubt acceptable cost will remain a key driver in providing frequency response services. So what happens when there is less convenient free inertia available from traditional plants?

In frequency response, time is of the essence: ideally, it is immediate. That gives one technology a key competitive advantage: batteries can respond effectively instantaneously (i.e. milliseconds), via automated software, and their costs are consistently falling. While batteries are largely seen as providing storage capacity to arbitrage between periods of high and low power prices, frequency response is in fact also a core part of their business case. Surprisingly, given Spain’s relatively high wind and solar generation (the former is well established but the latter is growing faster), it so far has relatively little grid-scale battery energy storage compared to other fast-evolving power markets. Perhaps until now it was deemed surplus to requirements, but that will surely change.

As they grow in scale and coverage, then, we might expect to see grid-scale batteries pick up the frequency response market share left behind as older plants get gradually phased out. In theory, this should make frequency response an increasingly valuable part of the battery investment case. In practice, it will depend on the specific dynamics and design of each market, and whether the mechanisms and incentives are in place to ensure batteries are utilised to provide this service and compensated accordingly.

For more analysis on battery investment trusts, which have been recovering strongly in price over recent weeks, see Energized Edition 4. (Disclosure: Gore Street Energy Storage Fund (LON:GSF) has been in the Energized portfolio since late February, since when it has risen over 25% at the time of writing.)

Implications for thermal and hydro power plants

Demand for cost-effective inertia may provide a case for extending the lives of nuclear, coal or gas plants in certain markets, even if their share of actual generation may be declining. It may even justify recommissioning abandoned or otherwise to be decommissioned plants to operate as flywheels or “synchronous condensers” that provide additional inertia.

It seems unlikely to be the primary economic rationale for building new gas-fired power generation, given the cost and scope to be outcompeted by batteries in future, but it might provide a valid secondary driver. That in turn raises a different issue: bringing new gas-fired capacity online has become much more financially challenging – a topic to be covered separately very soon.

The challenges for the other types of legacy power plant will persist regardless. In mature economies at least, demand for inertia seems highly unlikely to suddenly reverse the structural decline of coal-fired power. Nuclear still faces its perennial issues with delivering new capacity on budget and schedule. Likewise, for new hydro and pumped hydro storage: the key issues remain cost, timeline and the limited stock of suitable locations. Renewed focus on grid resilience looks unlikely to fundamentally change that picture.

Implications for grids

The other area that will likely get more attention is grids themselves and particularly their interconnectivity: building out more and stronger domestic high-voltage lines and interconnectors as another way to strengthen grids, as the power mix evolves. Iberia has remained to date a relative island in power terms versus the main European continent. The sole Spain-France interconnector, which is a critical piece of infrastructure despite providing only 3% of Spanish demand, appears to have been an early casualty of the apagón’s cascading loss of power. By contrast, the UK is much less of an electricity island than Spain, with the luxury of 10 different power interconnectors connected to 6 other countries.

Beneficiaries will be the providers of cables, transformers, converters, switchgear and so on through the grid equipment supply chain. These companies are already experiencing high demand, with multi-year work backlogs, as covered in Energized Edition 5, which looked in particular at Denmark’s NKT (CPH: NKT), among other European cable manufacturers like Nexans (EPA: NEX) and Prysmian (BIT: PRY). Additional investment in high-voltage lines and interconnectors would provide yet further demand for these companies. (Disclosure: NKT and Nexans were added to the Energized portfolio in early April, since when they have risen over 22% and 15% respectively at the time of writing.)

One area of particular focus here may be grid-forming inverters. These can help to provide frequency response via “synthetic inertia”, as opposed to grid-following inverters typically used in renewables installations, which cannot. This brings us back once again to Siemens Energy (ETR: ENR) and Schneider Electric (EPA: SU) – key European manufacturers who are already riding a wave of popularity as leading beneficiaries of the wider electrification and power demand growth trend. As we write, Siemens Energy is at an all-time high of over €72, up around 275% from below €20 only a year ago, while at ~€215 Schneider remains ~20% below its January all-time high of over €270.

Implications for other grid-tech

Meanwhile, at the residential level, such incidents may also highlight the attraction of domestic self-generation for a new generation of “prosumers”: consumers who produce meaningful amounts of their own energy consumption. Residential solar panels and batteries, either stationary or in electric vehicles, can offer a degree of insurance against grid dependency. The idea of your home and car acting as an off-grid mini-power/battery station is alluring to the extent it is affordable. Protecting yourself from a brief blackout may not be sufficient incentive alone to rush out and buy that new kit today, but it might provide a little extra nudge to those on the fence.

Finally, in between the residential and grid-scale space, energy tech companies are increasingly exploring ways to aggregate all this distributed residential hardware into Virtual Power Plants, in which they are remotely controlled using specially designed software. This bundling can make distributed residential batteries behave effectively a bit more like a grid-scale battery, providing instant demand-side response by reducing load when needed. We expect this space to continue to mature as home energy tech becomes more widespread, enabling domestic batteries to also play a role in frequency management.

Key Commodities & Indices

European power prices remain well down year to date, particularly in France and Spain, while they have stabilised in Germany and the UK over the past month. This mirrors more stable gas prices at NBP and TTF after the sharp drop over February-April as demand has softened amid plentiful LNG imports.

LNG prices in Asia have been falling as Chinese demand has weakened notably with a focus on cheaper domestic production and Russian pipeline supply. Meanwhile in the US, Henry Hub fell from around $4.50/MMBtu in early March to below $3/MMBtu by 22 April, before recovering back above $3.60/MMBtu - around two thirds higher than this time last year. Increasing US LNG exports over the coming years imply a longer-term strengthening in domestic US gas prices alongside softer gas prices elsewhere.

Like the wider equity markets, clean energy indices had a more positive month since bottoming out on 8 April, but remain close to 5-year lows.

Important Disclaimer: This newsletter is for general informational purposes only and should not be construed as financial, legal or tax advice nor as an invitation or inducement to engage in any specific investment activity, nor to address the specific personal requirements of any readers. Any investments referred to in this newsletter may not be suitable for all investors. In reading this newsletter you acknowledge that it is your responsibility to ensure that you fully understand those investments and to seek your own independent professional advice as to the suitability of any such investment and all the risks involved before you enter into any transaction. Strome Partners accepts no liability for any loss or adverse consequences arising directly or indirectly from reading or listening to the materials herein and on our website and make no representation regarding accuracy or completeness. We accept no responsibility for the content or use of any linked websites and third-party resources. Future events are inherently uncertain and there can be no certainty that any assessments, projections, opinions or forward-looking statements provided or referred to herein will prove to be accurate.