ENERGIZED: Investment Insights on Energy Transformation

Edition 17

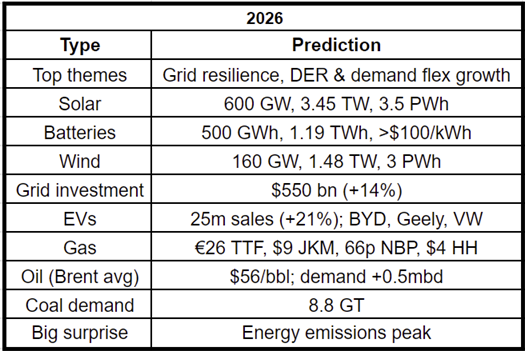

The year of energy resilience: top 10 predictions for 2026

31 January 2026

Please note: This newsletter is for general informational purposes only and should not be construed as financial, legal or tax advice nor as an invitation or inducement to engage in any specific investment activity, nor to address the specific personal requirements of any readers.

The last day of January is our self-imposed deadline for annual energy predictions, so here goes… Needless to say, these almost certainly won’t be exactly correct, but hopefully they help to clarify the direction of travel across the energy spectrum. Feedback is always welcome, especially where you strongly disagree!

This year the dominant global energy theme will be building resilience, in multiple forms from international to household level: by strengthening grids, boosting interconnections, expanding distributed generation (both grid-scale and behind-grid), scaling battery storage capacity (ditto), tapping into demand flexibility and accelerating electrification. These drive our top 10 predictions, plus one potential big surprise and 5 rising investment themes of the year.

Predictions:

Electricity: efficiencies and prices to slightly decelerate demand growth to ~3%, enabling clean generation to clearly overtake it and squeeze out thermal supply. European prices to average down over the year, but prices to rise across US grids.

Grid investment: to rise 14% to $550bn, topping half a trillion for the first time, as expansion programmes grapple with cost inflation and congested supply chains. The need to strengthen grids makes the electrification supercycle a mainstream investment, further boosting momentum for heavily backed-up electrical equipment and cable manufacturers, plus copper miners.

Solar PV: costs to stabilise. Annual installations to fall in bigger markets like China and US, but rise strongly across Africa, MENA & Rest of Asia, reaching 600 GW total, an 8% drop versus 2025. But that still means global cumulative capacity passes 3.4 TW (up 21%) and generation reaches 3,500 TWh, passing nuclear output.

Wind: strong momentum in Asia and Europe to drive 160 GW of global installations, pushing global capacity to 1.48 TW by year end, with generation reaching around 3,000 TWh. Investor sentiment to recover after a torrid few years.

Batteries: Stationary storage installations to reach as high as 500 GWh, passing 1 TWh cumulative by Q3. Lithium-ion dominance to strengthen into 4-8 hour durations, while pack prices remain >$100/kWh after rapid declines of previous years. Progress to accelerate in sodium-ion and solid-state, plus the quest for the long-duration holy grail to drive rising investment in thermal and liquid-air storage.

Distributed energy resources & demand flexibility: the behind-grid “horizontal revolution” in residential and commercial energy tech to accelerate across all regions, sidestepping grid constraints. Likewise, data centres to focus on Bring Your Own (BYO) power and storage. Virtual Power Plants (VPPs) to come of age with a Kraken IPO.

EVs: global sales to hit 25m (+21%), reaching just under 30% market share, as prices get more competitive and supporting infrastructure expands. BYD to remain top OEM, capitalising on high emerging market adoption, followed by Geely and VW. EV sales to hit 60% in China, where truck electrification also breaks through.

Oil: rising electrified mobility to displace ~2 mbd, reducing demand growth to just 0.5 mbd. Brent front-month to average $56/bbl. IOC share prices fall and at least one IOC CEO departs.

Gas: rising supply to pull average benchmark prices down to €26/MWh / $9/mmbtu / 66p/th (TTF/JKM/NBP), despite current volatility, and $4/mmbtu for Henry Hub. Even so, global demand recovery to remain weak, curtailed by increasing renewable output, battery capacity and transport electrification in major Asian importers plus continued structural decline in European demand. Summer price weakness triggers the first shut-ins of US LNG export capacity since the 2021-22 gas crisis.

Coal: demand nudges down to 8.8 GT, proving 2025 was the peak.

Potential surprise of 2026: peak energy emissions. The growth rate has already slowed over recent years, to 1.1% in 2025, equating to 38.1 GT CO₂e/pa. Increasing electrification and renewable capacity, fast-expanding battery flexibility and steady energy efficiency progress are combining to bend demand curves for the most emissions-intensive energy sources, coal and oil. These strengthening dynamics may even accelerate the first small structural decline in global annual energy emissions into this year.

Rising energy investment themes:

European energy security: political risks to gas supply refocuses minds on building Europe’s energy autonomy and resilience, via more local generation, heat electrification, grid-scale battery capacity and increased collaboration with Chinese energy tech giants to stimulate inward investment in manufacturing capacity

EMDE leapfrog & hybridisation: while China has dominated energy transformation to date, this year sees a notable shift. As China runs into the law of large numbers, momentum swings towards other emerging market and developing economies (EMDEs) across Asia, Africa, MENA and Latin America, where installation rates and adoption curves rise fast. This also drives surging investment decisions for giga-scale hybrid power projects, combining solar, wind and batteries to optimise output.

Cooling: rising A/C demand in a near-1.5c world, plus data centre cooling demand

AI as grid enhancing technology and energy efficiency catalyst: not just electricity demand driver

Advanced geothermal: in the US, on the promise of repurposing the oil and gas service sector towards clean generation at scale